Investments

in Companies with a Rich History and Strategic Potential for Future Growth

VIEW portfolioThe Spanish economy is one of the largest in Europe, and family businesses play a key role in it.

These companies provide a significant share of employment and impact many sectors, from agriculture and manufacturing to high technologies. Their resilience and diversity make family businesses in Spain particularly attractive to investors.

89 %

Share of family businesses among all private companies in Spain

67 %

Share of employment provided by family businesses in the private sector

57 %

Contribution of family businesses to the private sector GDP in the country

X-ray of a Family Business

sector view

COMPANY SELECTION

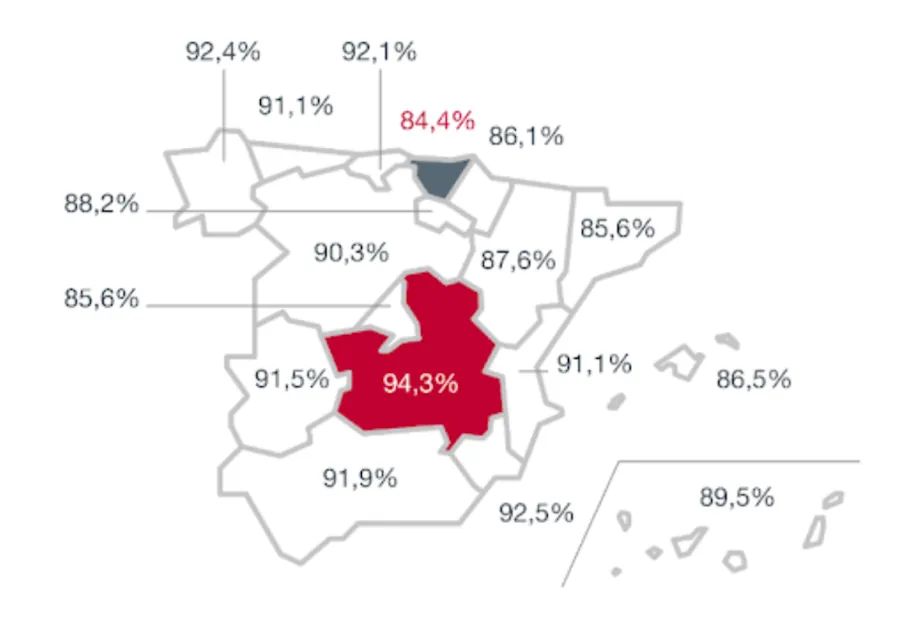

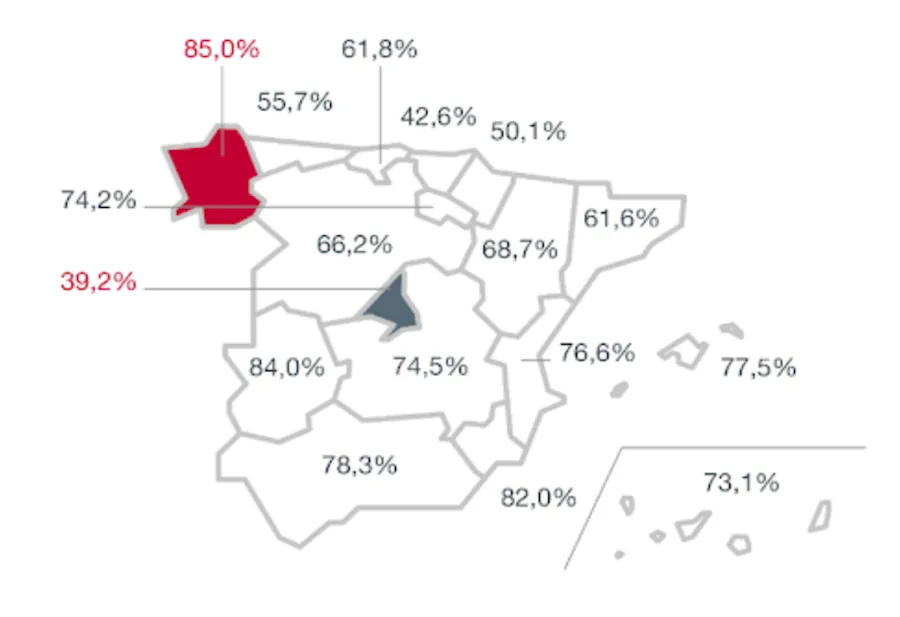

distribution by GDP

Reliable Investments with Growth Potential

Resilience to Economic Fluctuations

Family businesses in Spain demonstrate high resilience to economic crises. With flexibility in decision-making and strong relationships with suppliers and customers, they can quickly adapt to market changes.

Intangible Assets as Value

These companies possess valuable intangible assets, such as history, reputation, and strong community ties. This significantly increases the value of the business and represents an important part of the company’s capital.

Continuity and Stability in Management

Family businesses in Spain ensure stability through continuity in management, minimizing risks of sudden changes in strategy or leadership. This creates a solid foundation for long-term planning and business strengthening, which is especially important for investors focused on stable and predictable results.

Tailored Partnerships Begin Here

How does a family legacy become a profitable asset?

VIEW portfolioHow We Work

stage 1

Defining investment goals, establishing selection criteria for investment opportunities, identifying potential investment targets, and analyzing the financial health and investment attractiveness of companies.

stage 2

Conducting due diligence, assessing investment risks, analyzing macroeconomic and industry trends, evaluating the competitive environment, identifying and assessing risks specific to the investment project. Defining investment objectives, selecting optimal investment tools, and developing an action plan for executing the investment strategy.

stage 3

Determining the optimal jurisdiction, taxation, and deal structure, preparing documentation, and negotiating with sellers/owners of companies.

stage 4

Structuring the deal financing, securing loan funds, and seeking co-investors (optional).

stage 5

Legal support, ensuring compliance with deal conditions, advising on tax matters, and providing ongoing consulting.

stage 6

Monitoring the activities of companies post-investment, making decisions to optimize the investment portfolio.